Real Estate Safe Harbor . Individuals and entities owning rental real estate can treat. the irs today released an advance version of rev. in february of this year, the irs published a proposed safe harbor for owners of certain rental real estate interests who. Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following three safe harbors. to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the.

from www.slideserve.com

in february of this year, the irs published a proposed safe harbor for owners of certain rental real estate interests who. Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. Individuals and entities owning rental real estate can treat. real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following three safe harbors. to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. the irs today released an advance version of rev.

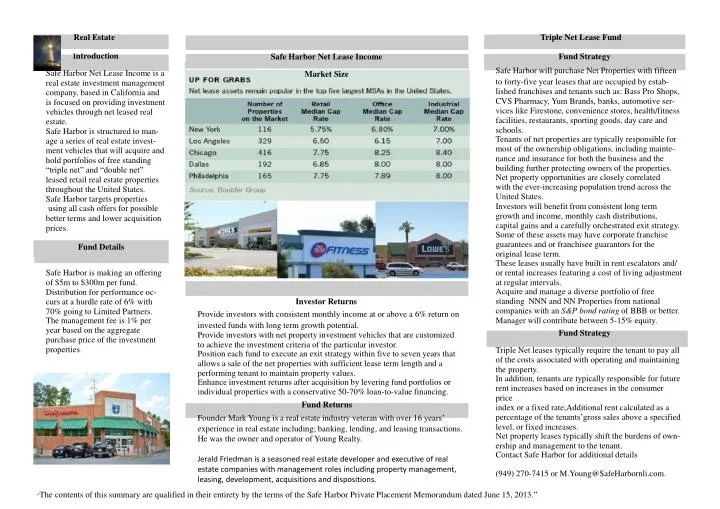

PPT Real Estate I ntroduction Safe Harbor Net Lease is a real

Real Estate Safe Harbor Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. the irs today released an advance version of rev. this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following three safe harbors. Individuals and entities owning rental real estate can treat. Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. in february of this year, the irs published a proposed safe harbor for owners of certain rental real estate interests who.

From capitalhomemortgage.com

Safe Harbor Real Estate Capital Home Mortgage Full Service Lender Real Estate Safe Harbor to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following three safe harbors. the irs today released an advance version of rev. Individuals and entities owning rental. Real Estate Safe Harbor.

From www.robertprussocpa.com

IRS “Safe Harbor” for Section 199A Rental Properties Real Estate Safe Harbor this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. . Real Estate Safe Harbor.

From www.safeharbordev.com

Safe Harbor Development Real Estate Safe Harbor in february of this year, the irs published a proposed safe harbor for owners of certain rental real estate interests who. real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following three safe harbors. Once you understand the “how” and “when” you may find yourself better structuring. Real Estate Safe Harbor.

From proconnect.intuit.com

Solved Safe Harbor Election for Rentals (250 hour rule) Intuit Real Estate Safe Harbor this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. in february of this year, the irs published a proposed safe harbor for owners of certain rental real estate interests who. the irs today released an advance version of rev. to understand how a safe harbor requirement might run. Real Estate Safe Harbor.

From www.eisneramper.com

IRC Sec. 199A Trade or Business IRC Sec. 162 Real Estate Safe Harbor Real Estate Safe Harbor Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. the irs today released an advance version of rev. this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. to understand how a safe harbor requirement might run counter. Real Estate Safe Harbor.

From www.youtube.com

AGIKgqOZvRSvK27e7XNi_hiDYUnib3J7PblrFwSjfkmA=s900ckc0x00ffffffnorj Real Estate Safe Harbor Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. . Real Estate Safe Harbor.

From www.wgcpas.com

IRS Finalizes the Rental Real Estate Safe Harbor Test for the Section Real Estate Safe Harbor this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following. Real Estate Safe Harbor.

From www.pinterest.com

Maximize Your Tax Benefits with the Section 199A Safe Harbor for Rental Real Estate Safe Harbor this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. Individuals and entities owning rental real estate can treat. real estate investors and landlords stand to save plenty of tax dollars. Real Estate Safe Harbor.

From www.cbmcpa.com

IRS Issues Final QBI Real Estate Safe Harbor Rules Bethesda CPA Firm Real Estate Safe Harbor the irs today released an advance version of rev. Individuals and entities owning rental real estate can treat. real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following three safe harbors. to understand how a safe harbor requirement might run counter to an existing tax and. Real Estate Safe Harbor.

From www.safeharbornaples.com

Safe Harbor Real Estate Services Real Estate Safe Harbor Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. the irs today released an advance version of rev. to understand how a safe harbor requirement might run counter. Real Estate Safe Harbor.

From humaninterest.com

Starting a Safe Harbor 401(k) Plan Human Interest Real Estate Safe Harbor in february of this year, the irs published a proposed safe harbor for owners of certain rental real estate interests who. Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. the irs today released an advance version of rev. Individuals and entities owning rental real estate. Real Estate Safe Harbor.

From developersalliance.org

Safe Harbour 101 Developers Alliance Real Estate Safe Harbor to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following three safe harbors. the irs today released an advance version of rev. this revenue procedure provides. Real Estate Safe Harbor.

From oecdpillars.com

Pillar Two Transitional CbCR Safe Harbour Modelling Tool Real Estate Safe Harbor Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. Individuals and entities owning rental real estate can treat. real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following three safe harbors. to understand how a. Real Estate Safe Harbor.

From www.youtube.com

Tax Tip De Minimis Safe Harbor YouTube Real Estate Safe Harbor Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. Individuals and entities owning rental real estate can treat. the irs today released an advance version of rev. this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. real. Real Estate Safe Harbor.

From dentmoses.com

Rental Real Estate Safe Harbor for QBI Deduction Dent Moses, LLP Real Estate Safe Harbor to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. in february of this year, the irs published a proposed safe harbor for owners of certain rental real. Real Estate Safe Harbor.

From safe-harbor-form.pdffiller.com

Safe Harbor Form Fill Online, Printable, Fillable, Blank pdfFiller Real Estate Safe Harbor real estate investors and landlords stand to save plenty of tax dollars by knowing how and when to use the following three safe harbors. in february of this year, the irs published a proposed safe harbor for owners of certain rental real estate interests who. Once you understand the “how” and “when” you may find yourself better structuring. Real Estate Safe Harbor.

From www.slideserve.com

PPT Real Estate I ntroduction Safe Harbor Net Lease is a real Real Estate Safe Harbor Individuals and entities owning rental real estate can treat. to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. the irs today released an advance version of rev. in february. Real Estate Safe Harbor.

From www.youtube.com

Real Estate QBI Deduction Rev Proc 201938 Safe Harbor YouTube Real Estate Safe Harbor this revenue procedure provides a safe harbor under which a rental real estate enterprise will be treated. to understand how a safe harbor requirement might run counter to an existing tax and business strategy, consider the. Once you understand the “how” and “when” you may find yourself better structuring repair and maintenance schedules on your rental properties. . Real Estate Safe Harbor.